One of the first books that I read on technical analysis, way back in the early 1980s, was the one written by John Magee and Robert Edwards, titled “ Technical Analysis of Stock Trends”. My boss, Claude Lobo, had allowed a rookie dealer from Standard Chartered Bank in Colombo to sit beside me in the dealing room. And it was this young lady who borrowed my copy of the book for a few days, and it became a permanent loan🙂. Lesson learned!

But if I remember correctly, I saw the phenomenon of a head and shoulders formation with two heads illustrated in another book, "Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications" by John J Murphy.

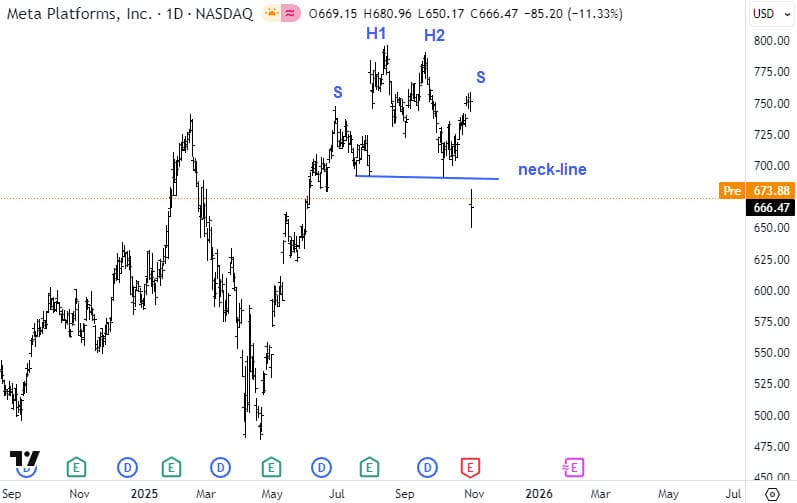

Of course, after I started with Elliott Waves, these classical patterns took a back seat. Yet, today, when I looked at the astonishing move in Meta, I found myself staring at a chart that resembles the same pattern. Take a look, and judge for yourself. Yes, the text book says the dip from the top of the head should ideally come to the neck-line, but we all know that text book examples are seldom seen in the real world!

Naturally, I also wanted to check whether I could see something using the Elliott-Wave lens. But first, you have a chance to support this website by taking a look at what the sponsor below has to say.

How High-Net-Worth Families Invest Beyond the Balance Sheet

Every year, Long Angle surveys its private member community — entrepreneurs, executives, and investors with portfolios from $5M to $100M — to understand how they allocate their time, money, and trust.

The 2025 High-Net-Worth Professional Services Report reveals what today’s wealthy families value most, what disappoints them, and where satisfaction truly comes from.

From wealth management to wellness, from private schools to personal trainers — this study uncovers how the top 1% make choices that reflect their real priorities. You’ll see which services bring the greatest satisfaction, which feel merely transactional, and how spending patterns reveal what matters most to affluent households.

Benchmark your household’s service spending against peers with $5–25M portfolios.

Learn why emotional well-being often outranks financial optimization.

See which services families are most likely to change — and which they’ll never give up.

Understand generational differences shaping how the wealthy live, work, and parent.

See how your spending, satisfaction, and priorities compare to your peers. Download the report here.

As you know, I always maintain that I don’t know the future. I have learned that just about anything could happen in the markets. What I offer with my methods is an approach, what successful traders know as an edge. And just because we have an edge, it doesn’t mean the market has to obey what we know as a probabilistic event!

So now, you too have witnessed a two-headed ‘monster’. But just like we learned at some point, that Santa Clause is not fo real, these SHS patterns could morph insto something else. That is why we have what are known as stops. Cheers!