An example of how wave structure identifies low-risk decisions before a trade begins. The emphasis is on when an idea becomes invalid, not on forecasting targets.

This example illustrates a central idea discussed in Why Intelligent Traders Misunderstand Elliott Wave: that analysis is most useful when it defines risk rather than predicts outcomes.

The Question Traders Usually Ask

Most traders approach analysis with a simple expectation:

“An indicator should tell me when to buy and sell.”

So they search for combinations — oscillators, averages, confirmations — hoping agreement between tools will produce reliability.

But after some experience, a problem appears.

Indicators often agree at exactly the wrong moment.

They confirm strength near highs and weakness near lows.

They create confidence where risk is greatest.

This is not a defect of indicators.

It is a misunderstanding of what markets allow us to know.

The Real Difficulty in Trading

The challenge in trading is not identifying direction.

Markets trend often enough.

The difficulty is identifying acceptable risk.

Most losses do not come from wrong ideas.

They come from ideas that are reasonable, but badly timed.

So the practical question is not:

“Is the market going up or down?”

It is:

“At what point does this opinion become expensive to hold?”

Traditional technical tools attempt to increase certainty.

But trading improves when uncertainty is defined, not removed.

What Wave Structure Changes

Wave analysis does not primarily forecast price.

It defines conditions.

Instead of producing a signal, it identifies a location where one of two things must happen:

behavior continues normally

behavior changes character

If behavior changes, the trade is exited quickly.

If behavior continues, risk was small relative to opportunity.

The method, therefore, does not attempt to be correct. It attempts to become wrong early.

This difference is subtle but decisive.

(The reasoning behind this decision-based approach is explored further in Five Waves to Financial Freedom.)

A Practical Illustration

The relevance of the example is not the eventual magnitude of the move, but the small distance to invalidation.

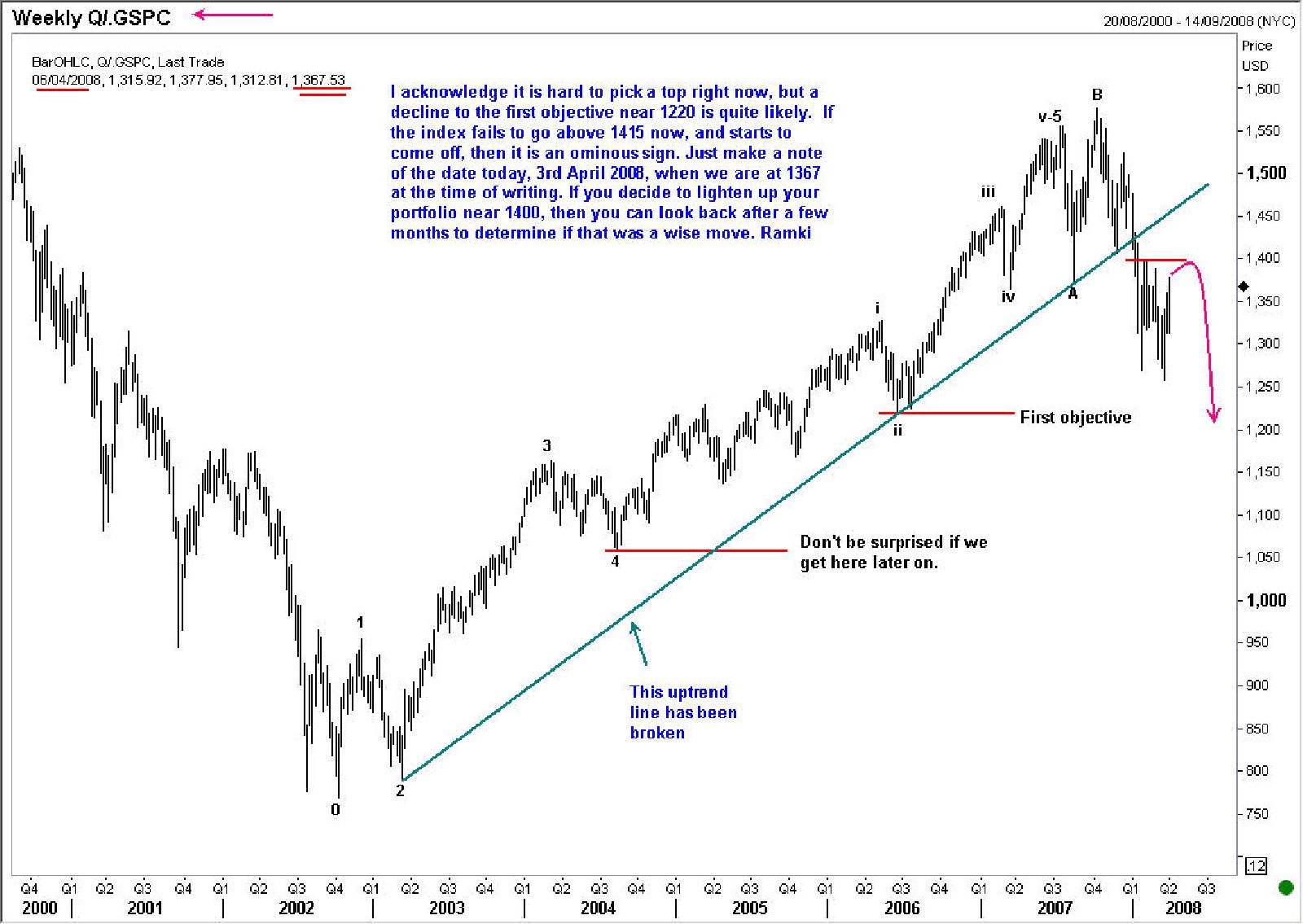

I would like you to consider the above chart carefully. I wrote this on 3rd April 2008, when the S&P was at 1367. This is a weekly chart (which is why the date on the chart shows the last day of the week). If you go to Yahoo-Finance and look up the data for the weekly highs and lows from that date, you will observe that after spiking for one day to 1440 on 19th May 2008, the index never returned to those levels until the Global Financial Crisis had ended. The lowest low of 667 was seen on 6 March 2009.

In this example, the analysis did not depend on predicting the full move.

The important observation was that price had reached a point where continuation required specific behaviour.

Failure to show that behaviour would invalidate the idea early.

The trade, therefore, began with a predefined exit, not a target.

Notice what mattered:

Not the eventual magnitude of the move,

but the small distance to proven wrongness.

That asymmetry, repeated consistently, produces results that prediction cannot.

Why Indicators Struggle Here

Indicators measure what has already occurred:

momentum already expanded

volatility already increased

trend already visible

They are excellent descriptive tools.

But trading decisions occur at the boundary between what has happened and what must happen next.

Wave structure focuses precisely on that boundary.

The Practical Takeaway

Elliott Wave analysis does not give certainty about the future.

It provides clarity about risk.

And in trading, clarity of risk is more useful than accuracy of opinion. The objective is therefore not to know the future, but to recognise when participation is justified.

These principles are discussed in more structured form in Five Waves to Financial Freedom, where the decision framework is developed in full.